A modern vehicle is more than a steel body and four wheels. It’s a combination of intricate sensing technology, advanced driver assistance systems (ADAS), real-time connectivity, and customizable salon elements that lead to a safer, comfier, and more entertaining driving experience.

At least in theory. Because though the technology is there, not all automakers understand how best to use it for creating an enjoyable infotainment experience and ensuring the comfort of drivers and passengers.

But innovation in driving experiences is what consumers have come to expect from OEMs.

Advanced safety, infotainment, and comfort features remain in vogue

As inflation and rising living costs (among other economic factors) jolt the global markets, 2023 may be another challenging year for the automotive industry. Still, some 14.8 million new cars are expected to be sold this year.

Buying activity remains strong in the premium segment. Six in ten luxury owners globally would be interested in purchasing a new top-shelf EV model next.

Consumers have become more price sensitive. Yet, most are ready to splurge on the right type of offer. Among US consumers, 55% name safety and 39% name high driving comfort as key criteria for new vehicle purchases. Also, nearly 8 in 10 US drivers signed up for a free trial of their vehicle’s connected services and nearly half converted to a paid subscription afterwards.

EU consumers are also willing to pay extra for ADAS, SOS assistance, OEM-provided insurance services, health and safety warnings, and remote vehicle monitoring functionality. In Germany, 44% of drivers are also open to paying for extra connectivity services on a per-use basis.

The wrinkle, however, is that consumers are often lack not aware of new vehicles’ safety, comfort, and entertainment features.

A recent survey of 4,500 car buyers in five markets found that almost half of respondents weren’t aware of ADAS features. However, among those who purchased an ADAS-equipped vehicle, the repurchase rate stood at 87% to 89%. In other words: Drivers get sold on ADAS after trying it.

Progress in consumer tech in digital services has created a new layer of expectations towards vehicles. People expect new cars to be at least as smart as their smartphones. Premium car buyers want even more sophistication in terms of performance, safety, and in-car styling.

The (r)evolution of in-vehicle infotainment systems

Over the past decade, the electrical/electronic (E/E) architectures of cars have significantly evolved. Today, software plays just as important a role as hardware. And investment in new software verticals is accelerating.

Software development efforts by domain

Source: McKinsey — Automotive software and electronics 2030

We’re entering an era where vehicles are equipped with high-performance computing units that are required to support advanced ADAS and semi-autonomous driving. The automotive sensor market has shifted to so-called smart sensors, which have a higher degree of edge processing capabilities versus raw sensors that send data to a central domain control unit (DCU). Thanks to smart sensors, vehicles can capture and process extra data insights from the real-world environment and connected systems to deliver drivers a safer and smoother cruising experience.

The sophistication of E/E architectures also steers a new approach to vehicle manufacturing. Access to ADAS features or extra infotainment services can now be provided on demand through software components rather than through extra hardware modules. Such software-driven development opens up ample revenue streams, from content subscriptions to access to new mobility services (car subscriptions, on-demand rentals, etc.).

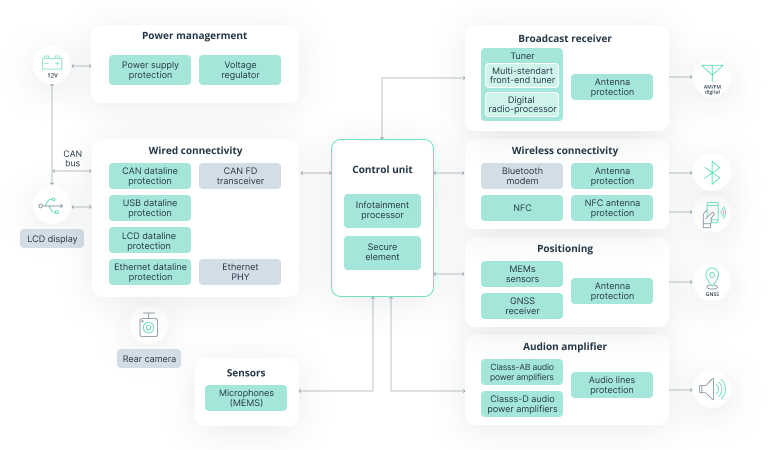

Software-driven development already impacts the design of in-vehicle infotainment (IVI) systems. OEMs now have more tech components such as wireless connectivity, cameras, and audio amplifiers to leverage in their system design.

Sample infotainment head unit architecture

Source: ST — Infotainment head unit

With so many tech building blocks in place, OEMs can create a multitude of innovative in-car experiences, ranging from in-car commerce to gaming systems.

In fact, that’s what market leaders already do.

Porsche’s latest IVI system comes with an advanced Charging Planner to manage its electric range as well as an improved real-time route building and navigation system. The IVI system also serves as a gateway to a range of value-added digital services Porsche has built over the years, which include real-time status updates, remote vehicle diagnostics, and advanced security controls.

In 2023, GM plans to launch Ultifi — an end-to-end software platform that will enable over-the-air software updates for supported vehicle models and provide subscription-based access to add-on services such as:

- Automatic child seat lock settings

- Hands-free advanced driver assistance systems

- Vehicle apps

- And more

Our research indicates that with the right mix of compelling offerings, customers are willing to spend $135 per month on average on [subscription-based] products and services.

GM expects in-car subscription services to generate nearly $2 billion in revenue in 2023 — and over $25 billion by 2030.

And GM is hardly alone in setting ambitious revenue targets for automotive software and services. Stellantis aims to make $23 billion by the end of the decade from its AI-powered software platform. Volkswagen expects 20% of its revenue to come from subscriptions and mobility services by the same date, with Renault making the same 20% pledge.

The numbers may sound ambitious, but they are realistic. Connected consumer services and paid add-ons have a profit margin of above 70%. By doubling down on software components, OEMs can not only reduce the cost of shipping new features but also become less dependent on the cyclical nature of vehicle sales.

Infotainment and comfort subscriptions serve as a steppingstone towards more predictable and recurring revenue due to a faster sales cycle and lower customer acquisition costs.

Subscribing to innovation: Competitive in-vehicle infotainment components

In-vehicle infotainment systems are a gateway to a new revenue model for OEMs. Similar to tech companies, automotive companies can adopt a platform business model, rapidly expanding into new market verticals via embedded computing and connectivity technologies.

If this is the growth trajectory your company wants to take, consider adding these in-demand comfort and infotainment features to your product roadmap.

ADAS

Autonomous driving (AD) may be the ultimate automotive industry goal, but consumers today care more about safety than self-driving. According to a AAA survey, 77% of Americans expressed more interest in improved vehicle safety systems than in fully autonomous vehicles.

That said, US drivers can’t always tell the difference between ADAS and AD. In 2022, 56% of drivers incorrectly classified current driver-assist technologies as fully automated self-driving technologies.

But among those who have sampled ADAS, adaptive cruise control (ACC) is a favorite. According to an AutoPacific survey, 70% of current vehicle owners across all demographics are considering ACC in the future — and 31% will want to have it regardless of the price.

Sitting at the intersection of autonomous and assisted driving, ACC makes real-time adjustments to the vehicle’s speed to adapt to current driving conditions. Technologically speaking, ACC also serves as a steppingstone to autonomous driving.

In 2023, Mercedes-Benz plans to release Level 3 conditionally automated driving in Germany and in two US states (Nevada and California). This would put them ahead of Tesla and GM, who only support Level 2. The new Drive Pilot system relies on sensors and cameras to control the vehicle on highways. This way, drivers can safely focus on secondary activities like communication or web browsing.

Chinese EV companies NIO and Xpeng have developed similar systems: NIO Autonomous Driving and the Xpilot ADAS solution. Both offer advanced assisted driving experiences. Stellantis plans to roll out a Level 3 system in 2024.

Reaching Level 3 autonomy is a major milestone for the industry. It also paves the way for safely pitching more entertainment services to drivers and passengers.

Still, plenty of other opportunities exist for improving ADAS systems. Safety and comfort features like park assist, autonomous emergency braking, automotive night vision, blind spot detection systems, and crosswind stabilization, among others, are in high demand among consumers. OEMs can implement them at the software level and distribute them as subscriptions to decrease the barrier to adoption.

Advanced routing and mapping

As with safety, consumers also demand a better navigation experience — and they’re ready to collaborate with OEMs to gain it.

Globally, over half of drivers are willing to share car data in exchange for:

- Updates regarding traffic congestion and suggested alternate routes

- Suggestions of safer routes (such as to avoid unpaved roads)

- Updates to improve road safety and prevent potential collisions

Demand for better trip planners is even more pronounced among EV owners and potential EV adopters, who are deterred by range anxiety. A limited driving range deters 40% of drivers from buying an EV. While better battery technologies are on the way, OEMs can reassure drivers today with smart EV trip planners that avoid no-return scenarios.

Intellias has helped one of our automotive clients develop an advanced EV navigation solution featuring HD maps, multi-stop planning, ETA predictions, charging time predictions, and a range of other convenient features for building EV routes. Drivers can easily evaluate the maximum driving distance on a single charge and plan stops to recharge during long-distance trips — all via a convenient in-dashboard app.

HD mapping will also become more important as we head towards wider Level 3 deployments and potentially (semi-)autonomous driving. Self-cruising systems depend on uninterrupted connectivity. If a GPS/satellite signal fails during tunnel travel, detailed mapping systems can help prevent accidents and detours. Advanced mapping systems also help determine the vehicle’s location in real time, which is a necessary feature for fleet management software that communicates ETAs and supports real-time route adjustments. Multiple players are looking for new ways to construct and maintain accurate maps.

One of the HD map-building approaches we have developed at Intellias is using a real-time streaming perception stack for generating HD map data based on vehicle sensing systems. Using collected static and dynamic data, we can generate 3D maps that enable precise vehicle positioning and navigation. The service is designed to facilitate direct-to-car and OEM cloud consumption, making it an excellent contender for subscription-based distribution.

Multiple HMI controls

Modern IVIs include wide touchscreen displays, supporting a range of on-screen hand gestures as well as multiple alerting modes. To provide a distraction-free driving experience, our team designed a range of HMI navigation components for a luxury vehicle OEM that combine the connected mobile device, vehicle head unit, head-up display, and rear-seat displays into one cross-linked system for guiding the driver. Passengers can also engage in route planning using rear-seat displays without distracting the driver.

At the same time, IVIs have benefited a lot from embedded connectivity. Almost 95% of new vehicles are connected and provide drivers with a range of services for navigation, diagnostics, and entertainment.

Mercedes-Benz has gone even further and offers an In-Car Office suite that allows drivers to easily join a conference call, browse to-do items, and build routes based on diary entries. Bigger displays have made typing easier. Yet texting and driving isn’t the best combination. That’s why truly innovative automakers are adding handwriting recognition to IVIs (with Intellias’ help).

But a great HMI experience isn’t just about touch. Drivers also rely heavily on voice controls.

In the US, 124 million people regularly use in-car voice assistants. Voice is a more convenient (and safer) medium for in-vehicle interactions, and 37% of consumers express willingness to pay extra for having a voice subscription in their car.

Yet the in-car voice experience is still far from perfect, as assistants struggle to recognize commands due to high noise levels.

Source: Capgemini — Voice on the Go

Since 76% of customers would use voice assistants more frequently if they had a positive experience with them, these shortcomings are worth rectifying. Speech recognition has made significant progress over the past years. New AI models like OpenAI Whisper perform with 50% higher accuracy compared to earlier models and can better recognize different accents and function even with high levels of background noise.

Voice-activated AI operating systems will likely become the third great OS wave — and the automotive sector will likely be at the leading edge.

In-car payments and commerce

Fueling up or charging, parking, paying tolls — drivers have to reach for their wallets a lot. But not for much longer as in-car payment technology spreads.

The latest vehicle models already have BLE, RFID, and NFC connectivity. Many also have built-in wallets for storing customer payment methods, essentially turning the car into a payment device (just like your smartphone).

By 2030, 600 million connected vehicles are predicted to generate over $500 billion in in-car transaction volume.

Apart from pocketing profits from in-car transactions, OEMs can play the longer monetization game. In-car payment processing allows OEMs to collect insights about vehicle owners, then suggest personalized deals for:

- Fueling or EV charging

- Connected parking

- Vehicle servicing and maintenance

- Entertainment services

Moreover, in-car payments will be integral to enabling another revenue stream — in-vehicle commerce. Ordering takeaway, placing a grocery order, booking a hotel room — a lot of purchasing already happens from inside the car. Why not take ownership of this stream, especially as more passenger infotainment screens are now present inside the vehicle?

Stellantis plans to launch the SmartCockpit cloud platform on all new vehicles by 2024. Apart from standard services like navigation and voice assistance, it will have embedded payment services and an ecommerce marketplace.

In-car payments will also facilitate the subscription purchases that many OEMs are now betting on. Embedded payments can also enable a better on-demand rental experience, allowing consumers to easily subscribe to a mobility service or a vehicle leasing deal without installing an app, going online, or visiting a dealership. Given that 52% of global automotive consumers are considering subscribing to their next car, prioritizing the development of payment solutions makes sense.

Embedded auto insurance

Few consumers have warm feelings about auto insurance shopping. For most, the process is daunting, to say the least. OEMs can reduce the pangs of shopping for auto insurance (and capture extra profits) by offering embedded insurance deals.

Embedded insurance is a technology-driven distribution model that allows insurers to package their products as APIs, which can be embedded into third-party software platforms (such as a car operating system).

For most automotive brands, insurance is already a standard upsell. Embedded changes the distribution channel from the dealership to the in-vehicle infotainment system. Moreover, such coverage can be more flexible, as many insurers now support pay-as-you-drive (PAYD) coverage based on OEM-supplied telematics data.

Tesla already offers a PAYD insurance plan in 10 states and is eyeing up national expansion. Stellantis launched a PAYD offer for French consumers in 2022, together with PSA Insurance. The Volvo XC40 comes with a three-year insurance plan backed by Allianz.

Ultimately, telematics can usher in a new wave of growth in the insurance sector — and OEMs can ride it.

OEMs have an opportunity to participate in the insurance ecosystem in ways we haven’t had in the past. Our access, our understanding of the technology that’s coming for vehicles, and the data that comes from those vehicles afford us a unique opportunity to be part of the insurance equation going forward. Brands will still be important, but tightly intertwining the auto and auto insurance ecosystems could be a more relevant part of the future.

Future auto policies can also include a preventive insurance component, rewarding drivers for good on-the-road behavior, regular car servicing, and timely maintenance done with authorized providers. This will allow insurance providers to improve customer satisfaction and loyalty while minimizing the friction of settling claims with insurance partners.

Speeding towards Subscriptions

For decades, OEMs have been in the business of selling hardware. But as the tech industry has shown us, software actually drives larger revenues thanks to its lower distribution costs and faster purchase cycles.

Infotainment and comfort features are the in-demand add-ons consumers are ready to pay for — and OEMs are already capable of delivering them thanks to innovations on the hardware level.

With a new generation of telematics control units and infotainment head units, OEMs can delight drivers with on-demand subscriptions to safety, comfort, and infotainment services, delivered and activated in a beat. High profit margins and drivers’ willingness to participate in subscriptions make this revenue diversification route one of the most attractive for this decade.

Intellias creates winning software solutions for global automotive and mobility brands. Contact us to discuss your strategy for subscription offerings.